ISSUE #3

A Shifting Risk Landscape as 2025 Approaches

The globalization of major industries over the past few decades has forced companies to adapt to new sources of volatility and risk. The pace of change was consistent and gradual to moderate. Now physical phenomena including migration, health and bio risks, politics and extreme weather are reversing these trends - creating new sources of volatility - while global digital and financial risks continue to ramp up. Lenders need to be more vigilant than ever.

Interesting Times delivers curated articles about events and trends that lie outside lenders' conventional view of borrower risk. It helps them understand how changes in the global macroeconomy impact their lending and risk mitigation strategies.

Watchdogs to address debt levels in non-banks

International financial regulators are showing concern about the private credit market. The Financial Stability Board (FSB) plans to address leverage risks in non-bank financial intermediaries (NBFIs) like hedge funds and private credit funds, publishing policy recommendations by early 2025. Highlighting the rapid growth of private credit and its ties to banks and institutional investors, the FSB warned of hidden risks and systemic vulnerabilities.

Read More >>

A double whammy of tariffs and strikes is coming for U.S. trade and the global supply chain in early 2025

U.S. manufacturers and retailers face rising uncertainty into 2025 due to potential new Trump tariffs and a possible mid-January ports strike. Tariff concerns are triggering early inventory pull-forwards, impacting operations, expenses and balance sheets. The ILA strike threat adds complexity to costs, freight routes and timelines. Combined with extreme weather events, companies are scrambling to make inventory decisions amid these rising political and macroeconomic risks.

Read More >>

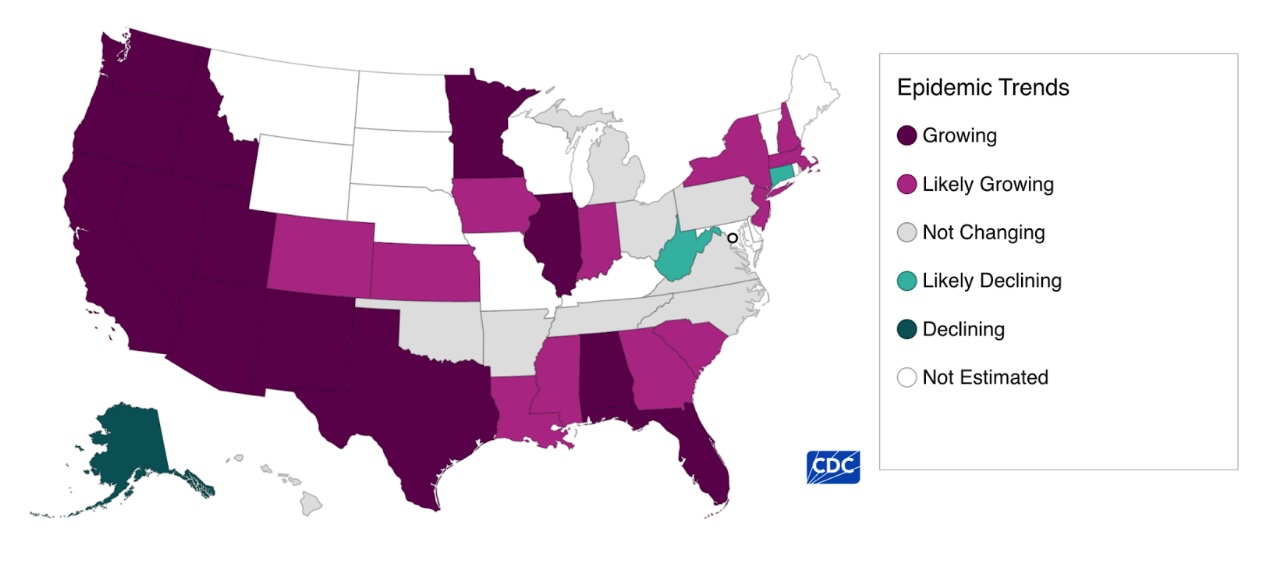

Current Epidemic Trends (Based on Rt) for States

Another epidemic is not on most lenders’ minds but the CDC reports that influenza infections are growing or likely growing in 25 states, declining or likely declining in 3 states, and not changing in 9 states. In contrast, COVID-19 infections are growing or likely growing in 3 states, declining or likely declining in 25 states, and not changing in 18 states. The recent controversy around vaccine immunizations may be contributing to these trends.

Read More >>

Change Healthcare breach affected 100 million Americans, marking a new record

The Change Healthcare data breach affected 100 million Americans in February, marking the largest healthcare data breach in U.S. history. The attack resulted in over $1 billion in losses and a $22 million ransom payment, and exposed personal information, including contact details, insurance data, and Social Security numbers. This breach has spurred Congressional bills and White House initiatives to establish stricter cybersecurity standards for the healthcare sector. Read More >>

Train your team to manage your risk with Shockproof!

P.O. Box 30304, Walnut Creek, CA 94598

Interesting Times is a free, regular publication of Shockproof Training.

Sign Up