ISSUE #5

2 Ways to Kill a Golden Goose

The US economy has been a standout since emerging from the pandemic, while its competitors to the East and West have faltered. Between mounting risks abroad and attractive local policies, globalization is reversing and American manufacturing is on the rise. That s the good news. The incredibly durable real estate cycle, elevating both residential and commercial properties in the face of higher-for-longer interest rates, natural disasters and a pandemic, is flashing orange.

Meanwhile, the release of the DeepSeek AI model demonstrated that you don t need billions to compete with the AI leaders. A Chinese company s product is democratizing AI, giving more bad actors an incredibly powerful tool to steal vast sums and foment chaos.

While the lending environment remains positive, the surface area of risks to borrowers is expanding.

Interesting Times delivers curated articles about events and trends that lie outside lenders conventional view of borrower risk. It helps them understand how changes in the global macroeconomy impact their lending and risk mitigation strategies.

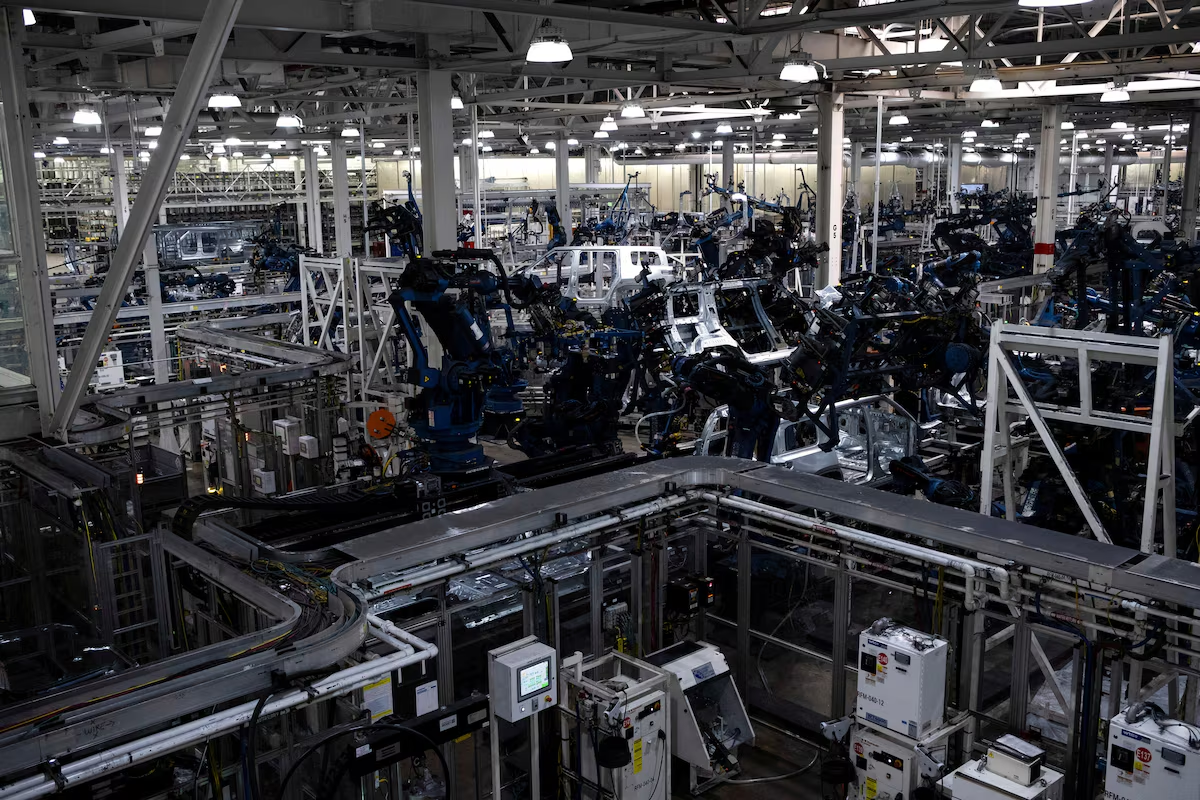

US manufacturing rebounds, tariffs could derail tentative recovery

U.S. manufacturing grew in January for the first time in over two years, with the ISM PMI rising to 50.9, signaling expansion. While President Trump paused 25% tariffs on Mexican and Canadian goods, a 10% levy on Chinese imports remains. Economists warn tariffs will raise costs and constrain growth, adding to multiple supply chain risks including extreme weather, political uncertainty and re-shoring. The result will likely include rising inflation and input costs.

Read More >>Climate Change to Wipe Away $1.5 Trillion in U.S. Home Values, Study Says

Climate change is projected to cut U.S. home values by $1.47 trillion by 2055, driven by rising insurance costs and homeowners avoiding high-risk areas. Wildfires, hurricanes, and floods are increasing, making some locations unlivable. While some areas will still grow, others like parts of California and New Jersey may see population declines. Insurance premiums are expected to rise 29.4%, affecting affordability and migration trends.

Read More >>ESG Watch: Companies complacent about cybercrime , despite rise in risk from AI

The World Economic Forum's Global Risks Report highlights cyber threats, AI risks, and misinformation among the top concerns. Cyberattacks on businesses are rising, with geopolitical tensions fueling state-sponsored threats. AI expands attack surfaces, making phishing and deepfakes more convincing. Europe leads in cybersecurity regulation, while firms struggle with outdated security models and skills gaps. Experts stress zero-trust frameworks and continuous supplier cybersecurity checks are necessary to counter growing threats.

Read More >>CRE Distress at $107B in Q4, Led by Office, Multifamily

The total amount of distressed commercial real estate assets in the US hit $107B at the end of Q4, a 24.3% YoY increase and new high for the decade. Office accounts for roughly half of the total ($51.6B), and multifamily distress may jump in 2025, with $108.7B in potential distress looming. Distressed property sales, while still a small portion of overall deal volume (2.5%), saw the largest share since 2015, suggesting things will get worse before they get better.

Read More >> Your team is your most valuable asset.Train it properly with Shockproof!

P.O. Box 30304, Walnut Creek, CA 94598 Interesting Times is a free, regular publication of Shockproof Training. Sign Up | #textUnSubLink#