ISSUE #8

Easing Rates and Regulatory Rollback Counter Mixed Industrial Activityand Loan Growth

US regulators are easing oversight under Trump, softening exams and disciplinary actions, even as banks tighten lending standards amid weaker demand. Commercial loan delinquencies dipped, suggesting stabilization, but manufacturing remains pressured by tariffs. Together, these shifts highlight mixed signals across credit markets and industrial performance.

Interesting Times delivers curated articles about events and trends that lie outside lenders'' conventional view of borrower risk. It helps them understand how changes in the global macroeconomy impact their lending and risk mitigation strategies.

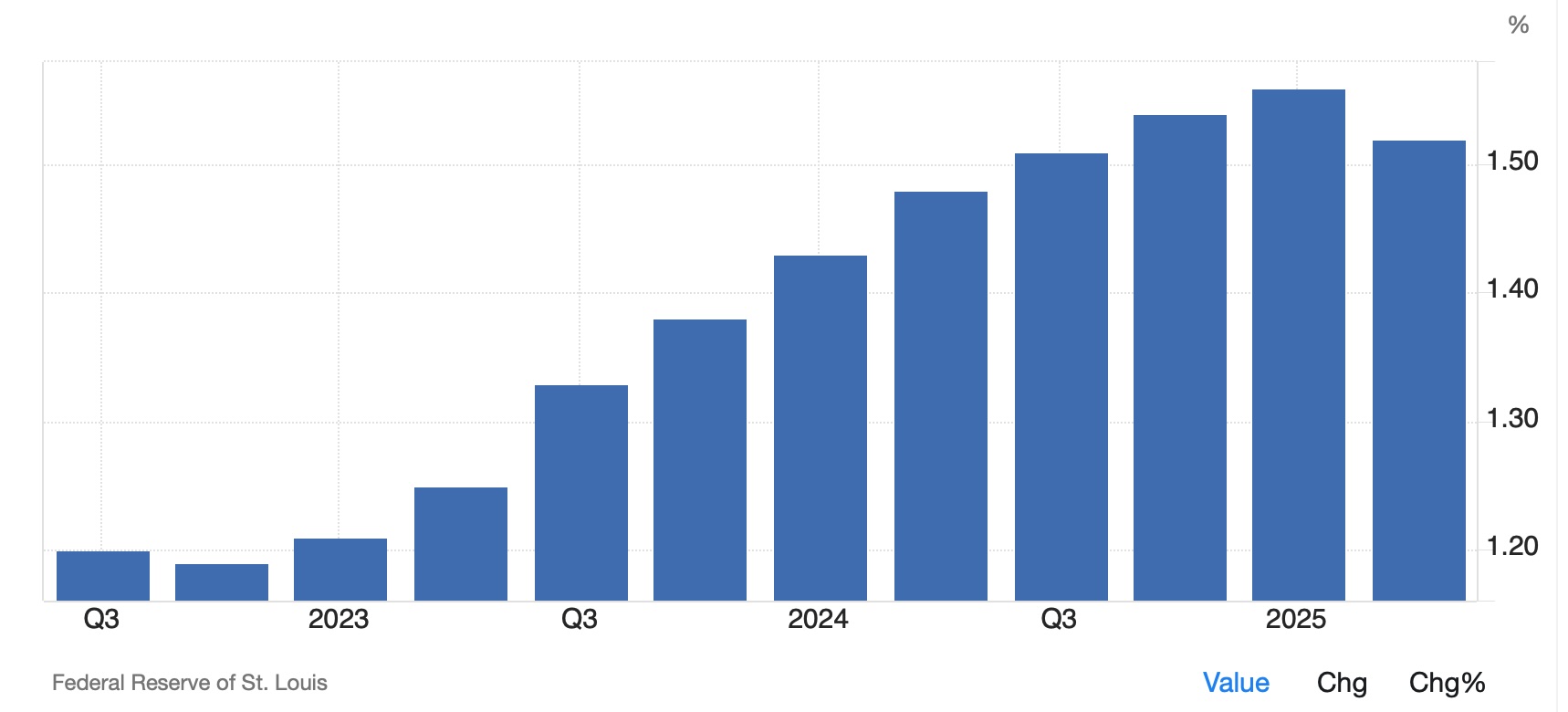

Commercial Loan Delinquency Rate Ticks Down in Q2

Commercial loan defaults ticked down to 1.28% in April, breaking an upward trend in defaults that started in Q3 of 2023, from a low of 0.98%. This rate is comparable to that experienced in Q3 of 2020 and below the decade s high point of 1.6% in early 2016. The prospect of lower interest rates should put downward pressure on the rate going forward. Read More >>

C&I and CRE Lending Standards Tighten as Demand Cools

The July 2025 Senior Loan Officer Opinion Survey (SLOOS) found tighter lending standards and weaker demand across most loan categories. For Commercial & Industrial (C&I) and Commercial Real Estate (CRE) loans, banks reported both tighter standards and weaker demand. Residential mortgage standards were unchanged, but demand was weaker; home equity lines saw tighter standards and stronger demand. For consumer loans, credit card standards tightened, while auto and other loans held steady. Overall, lending standards remain at the tighter end of the historical range. Read More >>

Bank Examination Rollback Underway

U.S. regulators under Trump are softening bank oversight, scaling back exams and confidential disciplinary notices while dropping scrutiny of reputational, climate, and DEI risks. The OCC, Fed, and CFPB say they are refocusing on core financial metrics capital, liquidity, and management to support growth and efficiency. Critics argue the lighter touch risks repeating supervisory failures tied to 2023 bank collapses. Banks, long frustrated with opaque and hostile exams, welcome the shift, with leaders like JPMorgan s Jamie Dimon openly challenging regulatory burdens and pushing back against aggressive initiatives. Read More >>

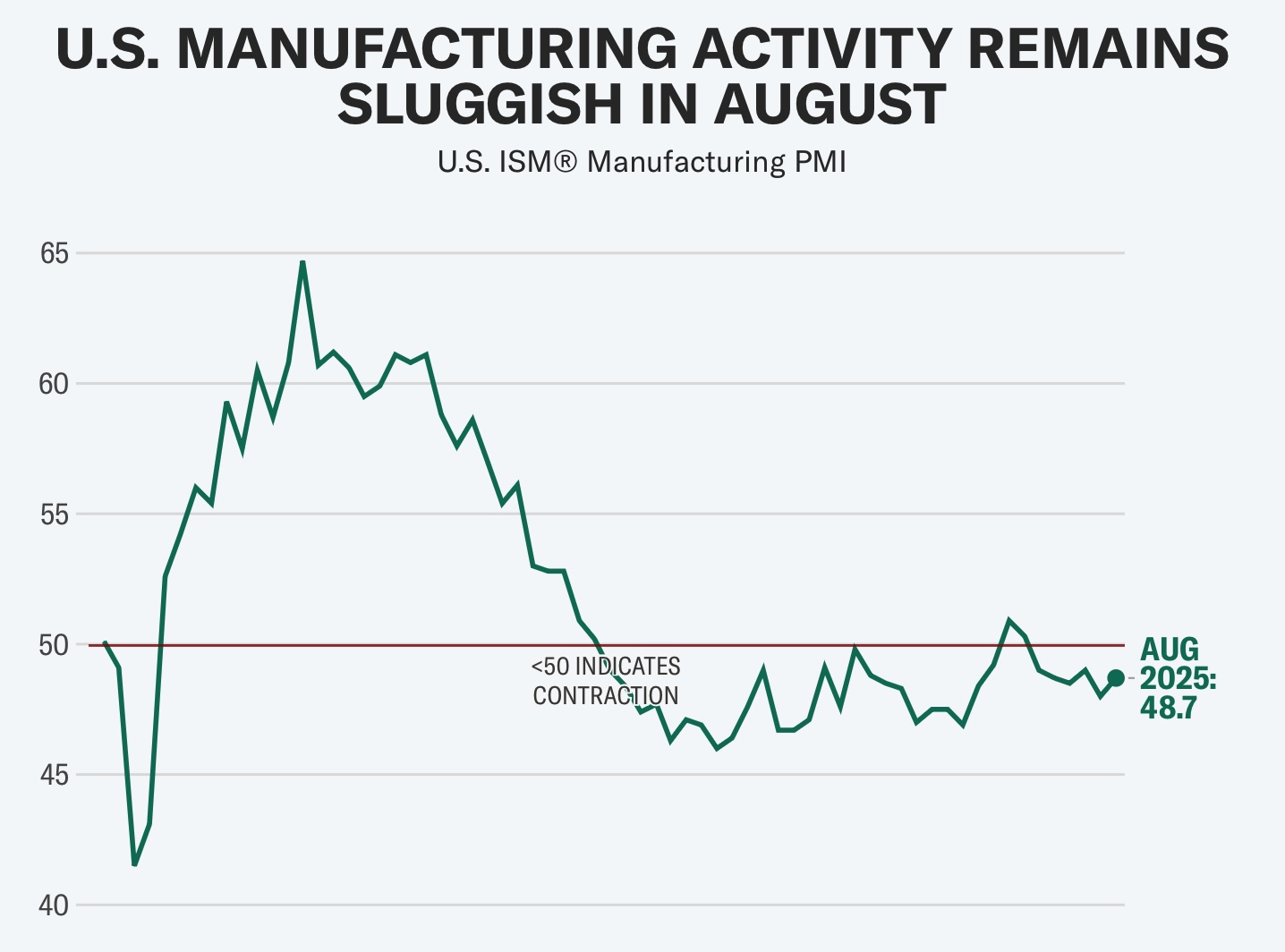

Manufacturing Activity Still Tepid

U.S. manufacturing contracted for a sixth month in August, with ISM s PMI at 48.7, slightly above July s 48 but still below 50. New orders rose to 51.4, yet production slipped to 47.8, offsetting gains. Tariffs pressured margins, pricing, and jobs, with some firms cutting 15% of staff. S&P Global s PMI offered contrast at 53, its strongest since May 2022, though tariff-driven input costs and rising factory gate prices raised concerns about consumer inflation ahead. Read More >>

Your team is your most valuable asset. Train it well with Shockproof!